💥 Step 3aaab: Getting Out of Bad Debt

Our Debt Crusher Calculator IS At the end of this course

🎯 Purpose of This Course

Bad debt can silently drain your wealth, increase your stress, and delay your financial freedom by years. But it’s not a life sentence — it’s a problem with a solution.

Step 3aaab: Getting Out of Bad Debt is designed to give you the knowledge, strategy, and timeline to eliminate high-interest, non-productive debt once and for all. This isn’t about quick fixes or shame — it’s about regaining control, protecting your future, and building a solid financial foundation for wealth.

“Bad debt is temporary. Freedom is permanent.”

🧭 What You’ll Learn

-

What qualifies as bad debt and why it keeps people stuck

-

How interest and time silently compound against your goals

-

How to face and organize all your debts clearly and confidently

-

Proven methods for payoff (Snowball, Avalanche, Hybrid, and consolidation)

-

How to build your emergency shield to stop taking on new debt

-

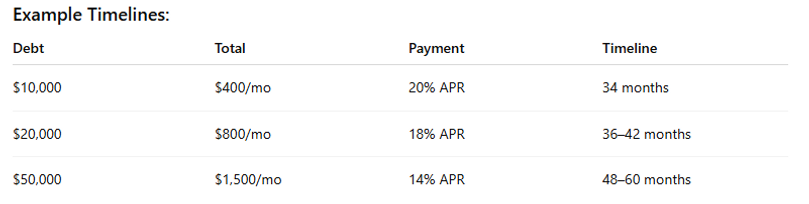

Realistic timelines for different levels of debt

-

How to use side income and budgeting strategies to accelerate payoff

-

How to rebuild emotionally after financial setbacks

-

How to stay out of bad debt permanently

🏦 Core Topics Covered

-

Understanding the debt trap and its hidden costs

-

Emergency buffers and no-new-debt rules

-

Payoff strategies and timelines explained step-by-step

-

Budgeting for attack mode and redirecting spending

-

Debt negotiation, consolidation, and (when necessary) bankruptcy options

-

Accountability systems and milestone tracking

-

Psychological recovery from debt stress

-

Long-term debt prevention systems

📈 Course Format

-

Sections: 30 structured lessons

-

Learning Tools: Debt inventory worksheet, payoff strategy planner, timeline charts, real-world case studies, reflection questions, accountability exercises

-

Format: Printable or digital workbook, fully compatible with the Life’s Wealth Quest curriculum

🚀 Who This Course Is For

-

Individuals overwhelmed by credit cards, personal loans, or payday loans

-

Families who want to break out of the bad-debt cycle permanently

-

Anyone who’s ready to face their financial reality without shame

-

Entrepreneurs or professionals looking to clear high-interest liabilities before scaling

-

People who want to take control of their financial timeline

🪜 What Makes It Different

This is not just a budgeting course.

It’s a debt escape system built on clarity, psychology, and action:

-

No shaming. No empty motivation.

-

Clear payoff strategies and realistic timelines.

-

Case studies that mirror real-life scenarios.

-

Emotional and financial rebuilding tools to prevent relapse.

-

Designed to fit directly into your Freedom Number strategy.

🏁 Expected Outcomes

By the end of this course, you will:

-

Know exactly how much bad debt you owe and to whom.

-

Have a personalized strategy and timeline to eliminate it.

-

Understand which payoff method works best for your situation.

-

Build your first financial shield to avoid falling back into debt.

-

Free up monthly cash flow to redirect toward savings and investments.

-

Lower your Freedom Number and accelerate your wealth timeline.

✨ “Debt is temporary when you decide to take control.”

📘 Introduction: Escaping the Debt Trap

For millions of people, bad debt isn’t just a financial problem — it’s a weight that affects everything: confidence, health, relationships, and dreams.

Bad debt is what keeps people working longer, worrying constantly, and living in financial survival mode. It’s the silent killer of wealth-building potential.

The good news? Bad debt can be defeated.

No matter how overwhelming your situation feels, with the right methods, timelines, and mindset, you can dig out — and more importantly, stay out — of the hole for good.

This lesson will give you:

-

A clear understanding of what bad debt really is,

-

Proven strategies for eliminating it efficiently,

-

Step-by-step payoff methods,

-

Realistic timelines, and

-

Case studies from people who’ve done it.

“Bad debt is like quicksand — the longer you ignore it, the deeper you sink. But once you learn where to step, you can climb out fast.”

🧠 Section 1: What Is Bad Debt?

Before you can escape something, you need to see it clearly.

Bad debt is any debt that:

-

Takes from your future instead of building it,

-

Is tied to a depreciating asset or no asset at all,

-

Costs more than it earns,

-

Was taken on impulsively or without a return plan, and

-

Restricts your financial freedom rather than expands it.

Examples of Bad Debt:

-

High-interest credit cards

-

Payday loans

-

“Buy now, pay later” plans

-

Overpriced car loans

-

Consumer loans for furniture, trips, or gadgets

-

Revolving credit used to survive, not invest

Why It’s Dangerous:

-

High interest compounds against you.

-

Payments consume your monthly cash flow.

-

It delays or destroys your ability to build wealth.

-

It grows silently over time.

Bad debt isn’t just about numbers. It’s about control — and right now, that control belongs to the lender.

This lesson is about taking it back.

⚠️ Section 2: Why People Get Trapped in Bad Debt

Understanding how you got here is just as important as how you’ll get out.

Common Triggers:

-

Emergencies with no savings → Credit becomes the fallback.

-

Lifestyle inflation → Spending grows with income, leaving no cushion.

-

Emotional spending → Using debt to feel better or escape stress.

-

Cultural normalization → “Everyone has debt” becomes the excuse.

-

Poor financial education → Not understanding how interest works.

Debt Spiral Example:

-

Borrow $1,000 to cover a gap.

-

Can’t pay in full → pay minimum → interest grows.

-

Gap gets bigger → borrow again.

-

Cycle repeats.

“Bad debt often doesn’t start with a big purchase. It starts with a small compromise that compounds.”

📉 Section 3: The Real Cost of Bad Debt

$17,000 in debt → $29,400 in total repayment.

That’s $12,400 paid to lenders… just for borrowing.

This is why speed matters. The faster you attack bad debt, the less power it has.

🧭 Section 4: Step 1 — Face the Numbers

Many people never truly calculate their bad debt. They avoid it, guess it, or round it down.

That ends here.

Debt Inventory Checklist:

-

Total amount owed

-

Interest rate for each debt

-

Minimum payment

-

Remaining term or timeline

-

Type of debt (credit card, loan, etc.)

-

Emotional impact level (optional but powerful)

👉 Total owed: $19,300

👉 Total minimum payments: $810/month

👉 Interest drain: ~$320/month

Step 1: Know the battlefield.

🧮 Section 5: Step 2 — Build Your Emergency Shield

Bad debt grows when life happens and you have no buffer.

Before aggressively paying down debt, build a starter emergency fund (usually $500–$1,500, preferred amount $2,000 +).

This prevents:

-

More borrowing when the car breaks down,

-

More credit card swipes for surprise bills,

-

Emotional panic when something goes wrong.

Think of this as putting on armor before the battle.

📌 Your first win isn’t debt freedom. It’s stopping the bleeding.

💰 Section 6: Step 3 — Stop Adding New Debt

This might sound obvious, but it’s often the hardest step emotionally.

-

No new credit card charges.

-

No “I’ll pay it off later” purchases.

-

No upgrades disguised as needs.

Every new dollar added delays your freedom.

Practical tips:

-

Freeze credit cards (literally — some people put them in the freezer).

-

Remove stored cards from online accounts.

-

Switch to debit or cash for daily spending.

-

Make no new debt a non-negotiable.

👉 This step alone can create momentum faster than any fancy strategy.

🏁 Section 7: Step 4 — Pick a Debt Payoff Strategy

There’s no “one size fits all.” What matters most is picking a strategy and sticking to it.

❄️ Snowball Method — Motivation First

-

Pay off the smallest balance first.

-

Roll that payment into the next debt.

-

Builds momentum and confidence fast.

📊 Example:

-

$1,000 (min $50), $5,000 (min $150), $10,000 (min $300)

-

Pay off $1,000 first → now $50/month goes to next debt

-

Each debt eliminated makes the next fall faster.

🔥 Avalanche Method — Math First

-

Pay off highest interest rate first.

-

Saves the most money in interest.

-

Takes more patience early on.

📊 Example:

-

24%, 18%, 9% → start with 24% first

-

Interest drops significantly over time.

⚡ Debt Crusher Method — Motivation + Math

-

Use "The Credit Card Reversal Pause Plan".

-

This will free up the money you are paying on your credit cards. If you have many credit card payments try this. Please, note that this will not work with store cards only Mastercard, Visa, and Discover. For any bills or utility payments you can pay online, pay with your credit card. For example, the money that would have gone toward your electric bill, now goes on your credit card. Then, you pay your electric bill with that credit card. His bill needs to be higher than your minimum payment. Here is an example. Your Visa bill is $178 a month and your electric bill is $215. You would put the $215 as a payment on your Visa bill. Then, once it shows up as available credit. You then pay your electric bill. Now, you technically paid your Visa bill and still paid your electricity at the same time. Now, the $178 you would have paid on your Visa card, just got freed up. It can go toward paying off other debt or helping relieve financial stress. The best way is if you have store cards put the extra money on those. That way you can get rid of those quicker. Thus, leaving you with more

money freed up. If you have multiple cards. Do this with all non-store cards like Lowes, Staples, etc. If you have 4 Cards with $150 payments totaling $600.00. This process just freed up that $600. The example below can help you understand.

-

Credit Card 1: Monthly Payment $165.00

Cell Phone Bill: Monthly Payment $165.00

Pay the credit card bill for $165.00 and then pay your cell phone bill for $165.00

If need be pay a little more on the credit card to make sure you have the $165.00 available. This then technically cancels out Credit Card 1’s bill. So, now you have that $165.00 free for the month.

Do this for each non-store credit card (Example: Visa, Master Card, etc. If you have four (4) Visa cards at $165.00 a piece that’s $660.00 a month free to try to pay up other bills or pay toward store cards.

-

Take the amount you now would have put on your credit cards as a minimum payment and the extra amount you get from side hustles or saved money and use the "Snow Ball Method".

-

Start with one or two small wins using snowball.

-

Then split the amount of money you are saving from the " Credit Card Reversal Pause Plan" . Put 50% of it into the snow ball method, then put the other 50% into the avalanche plan. By doing this you are accelerating the debt payoff.

-

Keep paying 50% on your smallest debt until the first debt is paid, then move to the next smallest debt. Pay the remaining 50% on your highest debt. If the debt is the same "Highest Interest and smallest debt. Put 100% of you money on it.

👉 Choose the one that fits your psychology, not just your calculator.

🧠 Section 8: Step 5 — Set a Realistic Timeline

Freedom takes time, but clarity makes it faster.

Factors Affecting Timeline:

-

Total amount owed

-

Your income & budget flexibility

-

Interest rates

-

Commitment level

The goal is not just paying off debt — it’s owning your timeline.

📉 Section 9: Step 6 — Budgeting for Attack Mode

When getting out of bad debt, your budget isn’t just numbers — it’s your battle plan.

Key moves:

-

Identify non-essential spending you can redirect.

-

Automate minimums + extra payments.

-

Use a “debt line item” in your budget like a mandatory bill.

-

Funnel windfalls (bonuses, tax refunds, side hustle income) into debt.

📊 Example:

-

$400 cut from dining & subscriptions → $400 extra toward debt

-

$400/month = $4,800/year

-

On $10,000 debt at 18%, this can cut payoff time in half.

📊 Section 10: Case Study — Snowball Victory

👤 Case: Melanie

-

Total debt: $23,000

-

Income: $3,800/month

-

Minimum payments: $780

She chose Snowball:

-

Focused on 2 smallest debts first.

-

Gained motivation after paying off $1,500 in 3 months.

-

Rolled payments into next debt.

-

Picked up a weekend side hustle for extra $400/month.

🕒 Timeline: 28 months

💸 Interest saved: $5,700

🏁 Result: Debt-free and $600 monthly margin redirected to savings.

👉 Lesson: Early wins build unstoppable momentum.

📈 Section 11: Case Study — Avalanche Power

👨 Case: Kevin

-

Total debt: $37,000

-

Highest interest: 24% retail card

-

Focused on avalanche from day one.

-

Sold old car, cut expenses, and put every extra dollar on the 24% card.

-

Paid it off in 7 months, then crushed the 18% balance.

🕒 Timeline: 33 months

💸 Interest saved: $11,200

🏁 Result: Freedom + early investment growth

👉 Lesson: Avalanche works best for patient people who love seeing interest shrink.

🧭 Section 12: Side Income as a Weapon

When expenses can’t be cut further, increase income:

-

Freelance or consulting

-

Part-time work or delivery apps

-

Selling unused assets

-

Building a small side hustle

Every extra $100–$500/month speeds up payoff significantly.

📊 Example:

-

$10,000 debt at 20%

-

$300 extra/month

-

Timeline drops from 45 months to 26 months.

More income = more firepower.

🛑 Section 13: Avoiding Debt Payoff Pitfalls

Many people start strong and then stall.

Why?

-

Lack of emotional buy-in

-

Adding new debt while paying off old

-

Burnout from unrealistic expectations

-

No accountability

👉 Build systems, not motivation.

-

Automate payments

-

Track progress visually

-

Celebrate milestones

-

Protect your emergency fund

🧠 Section 14: Emotional Recovery & Mindset Shift

Bad debt doesn’t just drain your wallet — it weighs on your mind:

-

Shame makes people hide.

-

Guilt keeps them stuck.

-

Fear makes them passive.

Getting out of bad debt is as much mental liberation as financial.

-

Forgive past mistakes.

-

Stop identifying with your debt.

-

Shift identity from “I’m in debt” to “I’m getting out.”

“You are not your debt. You are your decisions moving forward.”

🧮 Section 15: Debt Payoff Tracker System

Track progress monthly:

-

Starting balance

-

Current balance

-

Payments made

-

Interest saved

-

Time shaved off

A visible tracker creates momentum. Watching debt shrink feels like watching chains break.

🧭 Section 16: Debt Settlement & Negotiation (When Needed)

In some situations, especially with unsecured debt, negotiation may help:

-

Contact creditors to negotiate lower interest or lump sum settlements.

-

Request hardship programs or forbearance if eligible.

-

Avoid shady “debt relief companies.”

⚠️ This requires:

-

Clear documentation

-

Written agreements

-

Understanding credit score impacts

👉 Best used strategically—not as a default shortcut.

🏦 Section 17: Debt Consolidation — Smart or Dangerous?

Consolidating multiple bad debts into a lower interest loan can:

✅ Lower interest costs

✅ Simplify payments

✅ Accelerate payoff

But it can also:

❌ Reset the clock

❌ Encourage reaccumulating debt

❌ Lead to a bigger problem if habits don’t change

👉 Consolidation is a tool, not a solution by itself.

🧮 Section 18: Good Debt Protection Systems

While not ideal, bankruptcy is a legal tool for a clean slate in extreme situations.

It should be considered when:

-

Debt is unmanageable. (All Debt Can Be Managed, Unless It Takes A Toll On Your Health And Emotions or Your Getting Sued))

-

No realistic timeline exists for payoff. If you can not pay off the debt in 7 years, then this maybe a option

-

Income is permanently insufficient

Types:

-

Chapter 7: Liquidation

-

Chapter 13: Repayment plan

👉 ****If considered, consult a qualified financial advisor or attorney.****

This is a final option, not a first step.

🧠 Section 19: The “Bad Debt Freedom Timeline” Framework

Timelines vary, but the direction stays the same.

📊 Section 20: Case Study — Total Debt Freedom

👩 Case: Michelle

-

Debt: $48,000 (cards + car loan)

-

Interest: Average 18%

-

Income: $4,500/month

Steps:

-

Emergency fund: $1,000

-

Stopped using cards

-

Used hybrid (Snowball + Avalanche)

-

Took on side design work ($500/month)

-

Paid off smallest debts fast, refinanced auto loan

🕒 Timeline: 39 months

💸 Interest saved: $14,300

🏁 Outcome: Debt-free, $700/month redirected to investing.

👉 Lesson: Bad debt is temporary when you make it a priority.

🧭 Section 21: Protecting Your Future from Bad Debt

-

Maintain emergency fund.

-

Automate savings & investing.

-

Keep lifestyle below income.

-

Review credit annually.

-

Use credit cards only as tools, never as crutches.

Freedom isn’t just about getting out — it’s about never falling back in.

🧠 Section 22: The Emotional Side of Debt Freedom

Many people experience:

-

Relief → “I can breathe again.”

-

Empowerment → “I’m in control.”

-

Momentum → “What’s next?”

This isn’t just about money. It’s about reclaiming your life.

👉 When the debt disappears, opportunities appear.

📈 Section 23: Reflection Exercise

-

How much bad debt do you have right now?

-

How did it build up? (Be honest, not judgmental.)

-

Which strategy feels right for you — Snowball, Avalanche, or Hybrid?

-

How much can you realistically pay monthly?

-

How can you protect yourself from new debt during the process?

-

What will your life feel like the day your bad debt is gone?

Write these answers down. This is your freedom blueprint.

🏔️ Section 24: Your Freedom Number and Debt

Remember your Freedom Number: the amount of income required to live on your terms.

Bad debt increases this number. Every monthly payment pushes freedom further away.

As debt shrinks:

-

Your Freedom Number drops.

-

Your required income lowers.

-

Your financial breathing room expands.

Getting out of bad debt isn’t just about “no debt” — it’s about more freedom.

🧭 Section 25: Accountability = Acceleration

Ways to stay on track:

-

Weekly or monthly check-ins

-

Join a debt-free community or mastermind

-

Share progress with trusted partners

-

Use visual trackers (spreadsheets, charts, wall thermometers)

“Debt is heavy alone. It’s lighter with accountability.”

💬 Section 26: Common Myths About Getting Out of Debt

-

❌ “You need a big income to get out of debt.” → No. You need strategy.

-

❌ “It’ll take forever.” → Not with focused momentum.

-

❌ “Debt is part of life.” → It doesn’t have to be.

-

❌ “I’ve made too many mistakes.” → Every debt-free story started with mistakes.

-

❌ “This won’t work for me.” → It works when you work it.

🧠 Section 27: Celebrate Every Win

Freedom isn’t just the final payment.

Celebrate:

-

Your first paid-off card,

-

Hitting $5,000 eliminated,

-

Every milestone you cross.

This keeps motivation alive through the long game. Treat Your Self, Go Out To Eat

📊 Section 28: Case Study — Debt Freedom as a Catalyst

👨 Case: David

-

Debt: $65,000

-

Minimum payments: $1,800/month

-

Income: $5,000/month

Action Plan:

-

Negotiated lower rates

-

Side hustle added $800/month

-

Avalanche method for interest savings

🕒 Timeline: 52 months

💸 Interest saved: $21,000

📈 Result: Invested debt payment stream into index funds after payoff.

👉 Lesson: The same money that trapped him became the money that set him free.

🧭 Section 29: The 5 Rules of Bad Debt Freedom

-

Face it fast. Avoidance grows the problem.

-

Pick one strategy. Clarity beats perfection.

-

Automate everything. Systems > feelings.

-

Protect the exit. No new debt, solid emergency fund.

-

Stay focused. Debt freedom is a season, not forever.

🏁 Section 30: Final Words — Your Exit Begins Now

Bad debt doesn’t care about your age, background, or dreams.

But it also doesn’t have to define you.

Every debt-free person started where you are right now — overwhelmed, uncertain, maybe even embarrassed.

And every one of them became free the same way: one clear step at a time.

You don’t have to be perfect.

You just have to be committed.

-

Face your debt.

-

Stop adding more.

-

Pick your strategy.

-

Stick with it.

-

Reclaim your future.

✨ “Debt is temporary. Freedom is permanent.”

This is the moment your debt story starts to change.

Not next month. Not “when things calm down.”

Now.